Lesson 15: The Income Statement

In the last lesson we spoke about recording all your out-goings and your income. This was then written into a ledger and organised into a record using the single-entry accounting technique. In Lesson 15 we are going to look at the Income Statement, or also known as the Profit and Loss Statement.

Normally the Income statement is an overview of how your business is doing over a set period. For most businesses that means they produce a profit and loss statement quarterly so they can ‘see’ what they need to do in the next quarter to improve, or at the very least be able to plan for the future when particular quarter are a bit slow.

Every market stall has good seasons and slow seasons. Some Stall owners choose to go on holiday for the quiet season and return to start selling again when the seasons pick up.

For example; you sell seasonal decorations. You carry in your stock, Easter cards, eggs and chicks for the big event. During Christmas you sell Cards again, Christmas tree decorations and tinsel. You do Mothers Day, Fathers Day and World Earth Day. All these will be super relevant in the weeks leading up to the large seasonal events, but we all know that in March very few folks are looking for tinsel!

For example; you sell seasonal decorations. You carry in your stock, Easter cards, eggs and chicks for the big event. During Christmas you sell Cards again, Christmas tree decorations and tinsel. You do Mothers Day, Fathers Day and World Earth Day. All these will be super relevant in the weeks leading up to the large seasonal events, but we all know that in March very few folks are looking for tinsel!

This leaves you with times when you are going to be quieter, so instead of being caught unaware, how about creating an income statement every 3 months to show how things are going for those past 3 month period.

I know it seems like you are just starting off and you have plenty to do, but this will only encourage you more as you get to understand your business and help you when year 2 comes round!

The Nuts and Bolts of the Income Statement

The Income statement is a very simple overview of your accounting so far. You are really only taking totals and representing them on individual lines.

Lets cover a few essentials of the Income Statement:

Revenue

Revenue and Sales

This is your gross sales. Think of any sale you make, whether it be a service or a pancake, that is classed as a sale. Don’t subtract anything from that sale, only add them up for the period you are making the Income Statement for and note it down. It normally sits at the top of your Profit and Loss Statement.

Cost of Sales

These are all the items you had to purchase and expenses you incurred to create/make that sale. In other words, you have to add up your tools, ingredients, any labour costs and any depreciation costs you have over that period of time. (Everything depreciates over time, see What is depreciation to learn more about it.)

Gross Profit

This is the simple part. Take your Revenue/Sales total and subtract the Cost of Sales total and you will be left with a Gross Profit Total.

Expenses

Marketing, Promotion and Advertising Expenses

You may have chosen to take my advice and begun advertising on Google Ads and/or Facebook Ads, so here you would add up how much that has cost you for the time period you are calculating. You may have created some sign boards or may have even paid to have some flyers made to hand out at your next market event. These get added up here.

General and Administrative Expenses

These are your additional expenses like, stall insurance, book-keeper costs, travel and rent that you pay for selling at the market. Think of them as indirect costs that you have because you have a business. Add these all up and note them down.

Other Expenses

This might be interest you have on a loan you took out for your business or perhaps you paid someone to develop a new decoration for Christmas time.

Total Expenses

Now you will need to add up your expenses, which include Marketing, Promotion and Advertising, General and Administrative and Other expenses and note the total.

Earnings before Tax

To get your total here you will now need to take the Total Expenses amount and subtract that from your Gross Profit. This should give you an idea of what you are making and hopefully be a positive number!

Taxes

The last two items on the Income statement will be to do with taxes. Like I said before, you will need to understand how you pay tax in your country to be able to work out how much you need to pay on what you have earned. Some countries have a limit that you can earn before you incur taxes so for some of us this firgure will be zero if you are below that amount.

Net Earnings (Loss)

Finally, you will subtract your taxes from your Earning Before Tax and you will be left with a Final Total of what you really earned for the period you are calculating. It should be a positive number if you are making money and will be negative if you are losing money.

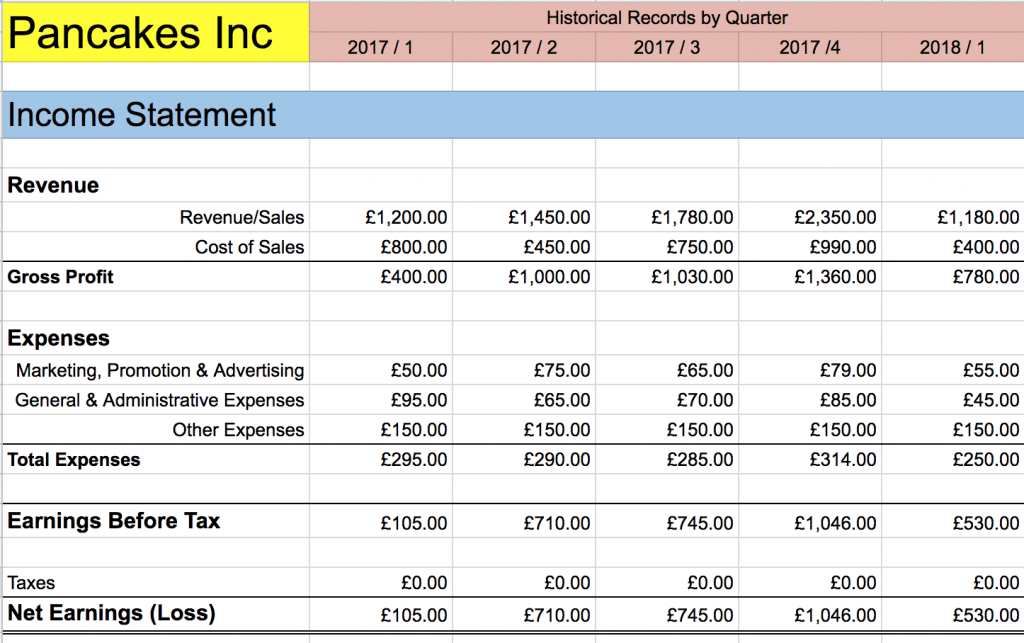

Here is what it looks like on a spreadsheet. You can download a copy by clicking Income Statement / Profit and Loss Statement

Here you can see Pancake Inc is not doing too bad over the year and it certainly is beginning to show that people will buy more pancakes in the later part of the year than at the beginning. This then allows the owner of Pancake Inc to begin to make plans on what to expect as the years unfold.

There are no taxes either because overall they have not earned enough to pay tax on the net earnings when totalled over the year.

Conclusion

Accounting for your business should not be difficult or time consuming. When it begins to become overwhelming, get a book keeper and rather focus on what you know you are good at. We are all suited for different roles and I can tell you from experience that learning a new skill in which you have no interest takes far longer and far more effort than appealing to your strengths.

Don’t neglect your finances just because you think you are ‘only’ a small stall owner just starting out with low turn over. Getting the basis right while you are small will inspire you as you grow your business.

I look forward to seeing you in the next lesson discussing the Balance Sheet which will draw all our finances together and give us a great way to know exactly where we are with our finances at an exact moment in time!