Lesson 18: Single or Double Entry Accounting

In the last lesson, we discussed accounting and why there is a benefit to not only keeping accurate records but how it can also drive your business forward.

It doesn’t mean you have to be a trained financial accountant, but knowing where your money is going and how you are getting it in is a big step to realising the potential your business has.

If you have missed any of the other modules of the course, have a look at How to Start a Market Stall and find out how you can be a better market stall trader.

***What you read below is for educational purposes and not legal or financial advise. Please consult an account for further information regarding accounts and how to keep them.***

Types of Accounting

There are many different ways to keep track of your cash flow, but we will mainly be looking at Single Entry Accounting and Double Entry Accounting here. If you feel you are on the level of Enron, then I urge you to consult a qualified accountant and a very good lawyer!

The way we account for our money can be as simple as placing money in a tin and then taking money out of that tin. This is essentially what accounting look like.

There are very complex ways to account, and although I am aware of this form of witchcraft, I choose to only understand it and no more.

If we continually think about that tin with the money in it, then accounting will become very easy to a market trader starting out.

The Power of the Money Tin

Think of an imaginary tin, and, as with every business, you need to put money in the ‘tin’ to get started. This is known as capital for the business.

Once the money is in the tin, you can now move forward and begin planning your stall and your products. Your new business may sell pancakes at the market. This is what you will need to start trading:

- Stove/gas ring/fire

- Electricity/gas/wood

- Frying Pan

- Ladle

- Spatula

- Oil

- Eggs

- Flour

- Milk

- Sugar

- Lemon

- Cinnamon

- Syrup

- Serviettes

- Plates

- Hygiene licence

- Table Cloth

- Float box

- Small Change

- Cleaning items

- etc…

This is all for a pancake stall and all these items are part of the startup cost. That must all come out of the “Tin” – out of the startup capital.

Now you may already have a gas stove, a frying pan and even the ladle and spatula, so if you are going to add those to your business, consider them as capital too, it is just that you have added actual items to the tin, not just money.

Now you need to buy the ingredients which will come from the start-up capital you placed in the tin. Your rent for the day must come from the start-up capital and any other items, like transport or storage costs.

See how big this tin is getting?

Whatever you use for your stall and buy for it, must first come from the ‘tin’ and also return to the ‘tin’. Think of the money as changing into physical items and then magically as you sell something it changes back into money again. Cool thought really!

Keeping Records

You may have noticed that I very quickly had money going into the tin, then a lot of purchases going out of it again and then back into it. These are known as transactions and this is what needs to be recorded to keep track of what the money is doing.

The way you put things into the tin and take them out is what accounting is. The more detailed you make it the more you can analyse your business results.

Think of it this way, if I can show in one month how much flour I bought and how much I still have left, I know how much I can budget for flour next month.

Then we can budget over the year too.

Same for your transport. If every time you go to a market you list how much fuel you use or how much the transport was to get there and back, you will have a better idea of how much your transport bill is costing you month by month.

This is all accounting is trying to do for us. Make sense of what you are spending on and where you are receiving it from. Our brains are fantastic at recording the information we like, but we don’t hold accurate records of things we don’t like. The brain filters that all out.

Your guess at how your business is going is just that… a guess, and that is not how you will be able to grow!

How to use Receipts

Most of the time you will receive a receipt, or be asked if you need one – TAKE IT!

This is a record of what left the tin and in which form it left it. When it comes to later on when you are checking where the money has gone you will have the receipt to remind you, with a time and day attached to it.

This is known as reconciling, and you are really just making sure you have a true record for your money.

KEEP EVERY SINGLE ONE! Even print off the ones you receive electronically. (Unless you are doing everything electronically)

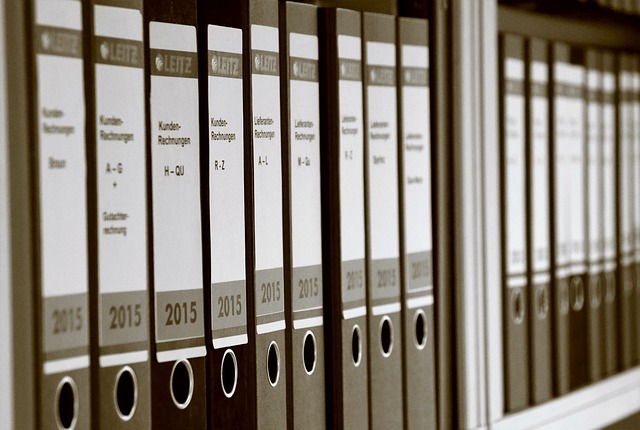

I know, sounds silly doesn’t it? Okay, this is really down to how you feel most comfortable, but you essentially need to keep these receipts for 5 to 7 years.

Some countries now allow the scanning of receipts as records, but if you want to make sure everything is covered, keep them all in a box, correctly filed and stored away, in the loft or someplace safe.

The way which seems easiest to do this, is to collect your receipts in a shoebox for that day or for that week. (I recommend day as it makes your book-keeping so much easier.) When that day or week is finished, reconcile each to your accounting records and place them in a plastic wallet in date order.

Label the plastic with the day or week, and place it into a filing box. Then repeat as each week passes.

Once a month is done, you can ‘close’ that plastic wallet and start again for the next month. Keeping everything in order going from back to front!

When you get to the end of the year, you make sure everything is placed in one box (if possible), label it and then place it out the way and forget about it. You are done with it until you or someone else needs to check something and you will find it easy to do that later on.

Single Entry Accounting

If you are starting out as a stall owner, you are probably using this method or will at least start with the method as it is the simplest way to keep your accounts.

You are normally a one-person business, and you do not need to worry about shares in the company and paying other employees or shareholders.

It is as it sounds too, you write down on one line:

- When you paid or received something (Service or product)

- What it was (Brief description)

- Amount

- Keep a running total

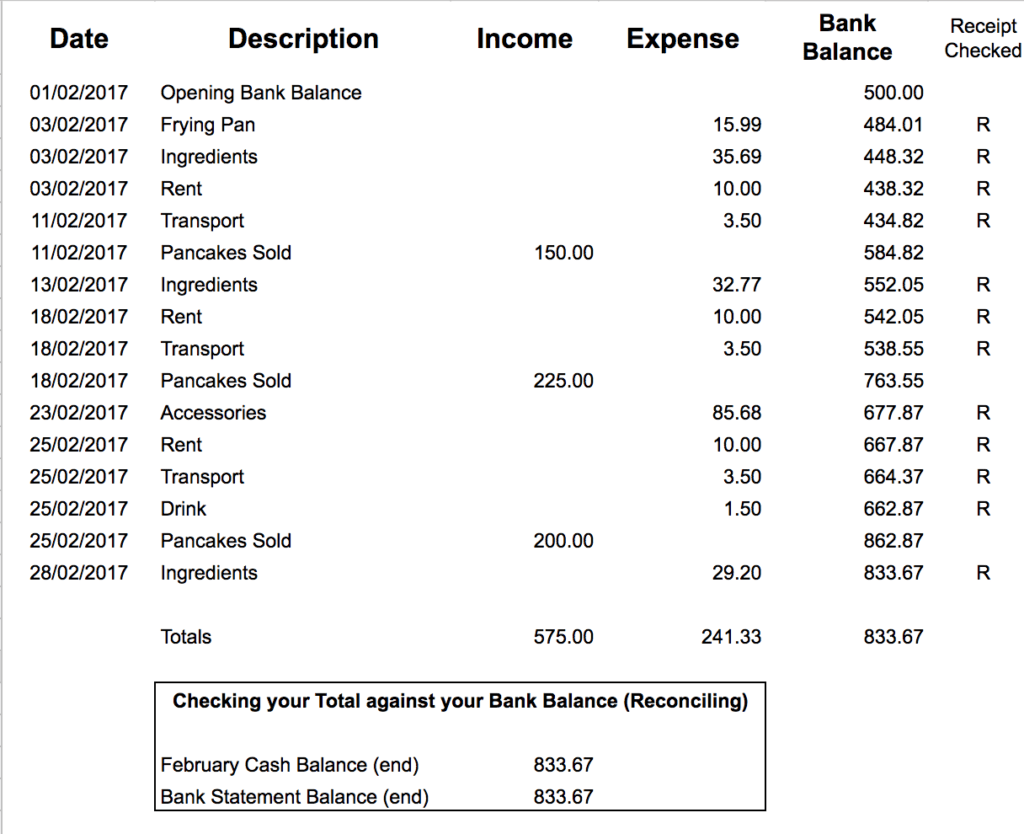

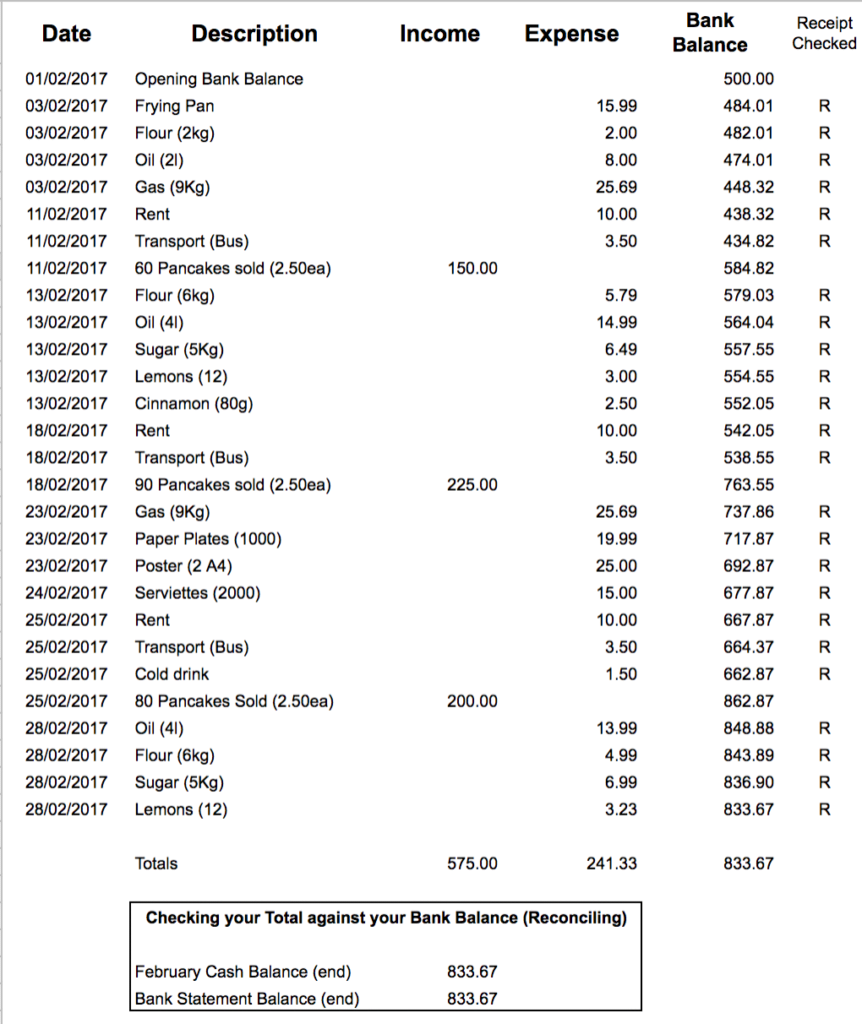

It looks like this in its simplest form in example 1 below:

Example 1

But I would recommend making it a little more detailed so it can help you later on to benefit your business.

Here is a more detailed example in example 2

Example 2

You can copy this form by clicking Single Entry Accounting and editing yourself.

(Note: The R on the right side is where you match a receipt with your entry in your accounts and then file it)

As you fill out each day you make sure you start with the previous day’s total, and you continue to add and subtract as you go.

At the end of the month, you check every item with your receipts, your bank statements and any invoices you have (outstanding or paid)

Then you close that months account with a total and a few notes.

It all begins again the next month and so it goes on.

You can do this in an A4 book or even in a special A4 ledger if you really want to do this right!

Just make sure you get into the habit of keeping the record up to date. There is no point saying you will do it later and then wasting hours trying to ‘remember’ what that amount was you spent 27 days ago!

Wasted time means wasted money for you as an entrepreneur. Remember to make your time count!

Double Entry Accounting

This form of accounting is used by the majority of medium and large size businesses. It is the best form of accounting to keep a check on what you are entering and for making a clear distinction of your costs.

Double entry accounting works by using one large tin as capital and lots of little tins for everything else.

There may be a tin called flour, or a tin for fuel, or even a tin for rental costs at the market.

In this form of accounting, you first need to make a note that you purchased flour, that means you need to show where the money came from.

You note that you take some money from the big tin and put it in the tin labelled flour. Then you make a note that you bought that flour in the small tin, and also note that purchase in the big tin. (double entry)

When you use that flour you then make another note that flour was taken from the flour tin.

Each time you make one note, you need to make another note somewhere else to show the money moving and changing into different things or back to money.

Each time it is a double entry.

These little tins are called journals and each product or service has its own journal. You will end up with lots of journals each month and each will show something coming in and something going out.

If you ever wanted to know what accountants and bookkeepers do, this is he majority of their work. Finding the right tin.

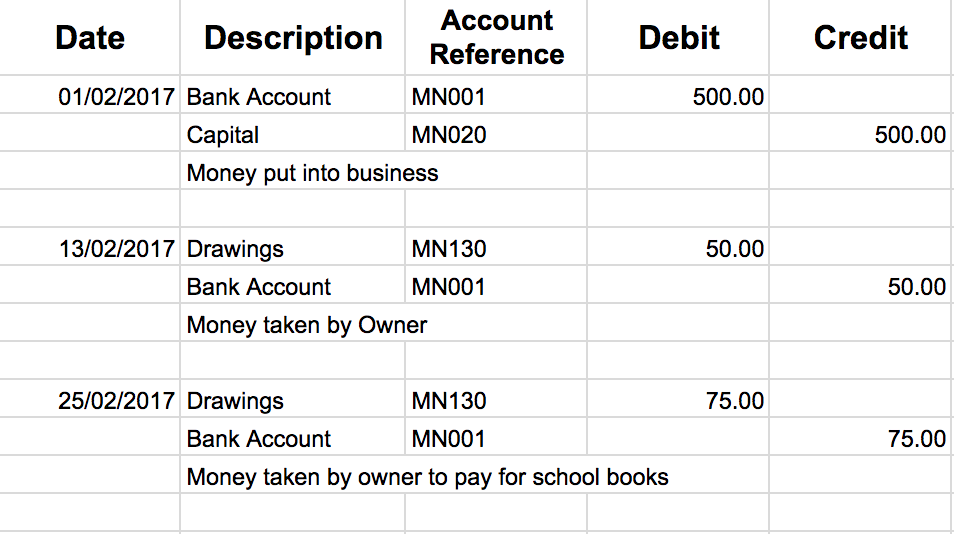

Here is an example of a journal in example 3:

Example 3

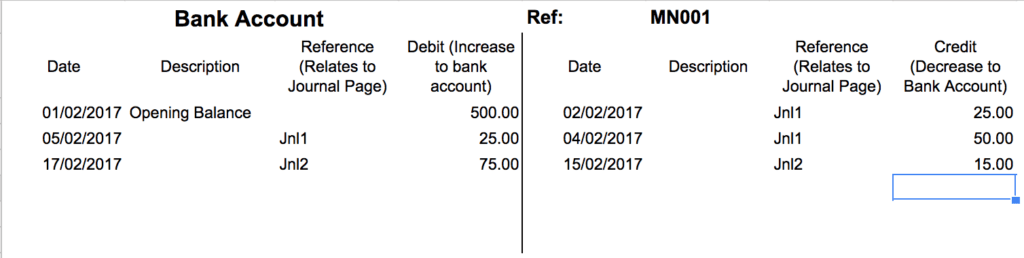

Each account reference is shown on a ledger and that shows the company accounts. Each entry must be detailed twice to show where it comes from and where it goes to. This must be shown in a General Ledger.

This is so the journals show a running balance and importantly, track what is happening to your money and assets. The General Ledger will only give very brief detail with a reference pointing back to a particular journal.

Here is an example of a general Ledger showing the entries in exmple 4:

At the end of each month, the amounts are totalled and a final figure produced. This must balance with your main account and with your journal entries.

That information forms a Balance sheet which is produced to show how the business performed.

There are plenty of easy programs that will work this out for you and produce your accounts automatically. If you go to Resources you’ll find I suggest Wave or Quickbooks to name two. Both work very well to keep your accounts ordered and up to date.

When to Hire a Bookkeeper

You must keep good records. There is no easy way to say it. If you know how to use these accounting systems then you will be able to sacrifice a short amount of time each week to sorting your accounts.

Accounting within your business will teach you so many lessons about how your business is run and make you very aware of how your money is being used, BUT please read on…

If you are being overwhelmed by this process – STOP!

Stop trying to understand it, hire a bookkeeper and sit with them for a little while and establish what they need from you every week, month and year.

Then pay them the money to sort your books out for you. You will be better off asking someone with experience, to give you a quick break down of your account and financial situation than waste weekends trying to understand it and still not fully be aware at what the numbers are showing you.

Accounting will wear you down! You will be lifeless and drained by doing your books if it isn’t your thing and you cannot get your head around it just yet.

Rather consider that you will be a better creative person, salesperson or cook and will sell far more if you don’t need to worry about the details of financial accounting the finer details.

Make sure you account for the extra outlay for a book-keeper in your sales. Your first sale may be money that you spend on your book-keeper each day, so it will spur you on to make the next sale even more, to turn a profit from your business!

Conclusion

There are very simple ways of accounting, and there are complex ones. A simple one line for everything you buy or sell will work for most small businesses.

If it doesn’t cause too much stress and time, I would urge you to try it out to understand where your money is coming and going. You’ll understand your business better too.

As I pointed out though, if you are going to be stressed, inhibit your creative flare and have a constant worry on your mind then hire a bookkeeper and work with them to make your business better. The outlay will pay you back every single day.

Is there a system you use which keeps everything in check for you? Let us know over on Facebook

PLEASE NOTE:

I am neither a qualified accountant or financial advisor, so this is given purely for educational purposes. Anything you are unsure about I urge you to seek professional council over.

Quick Quiz

- Name two ways of Accounting

- What is Reconciling?

- When should you use a book-keeper?