Lesson 20: A Market Stall Holders Guide to the Balance Sheet

You may have heard of the balance sheet and wondered what it is and why you should care about it. In this lesson we’ll be breaking it down in simple terms to make it work for you.

Imagine you’re running a market stall selling delicious bakery items like bread, cakes, and pastries. Knowing how to create and use a balance sheet can really help you understand how your business is doing.

What is a Balance Sheet?

A balance sheet is a financial statement that shows the financial position of your business at a specific point in time.

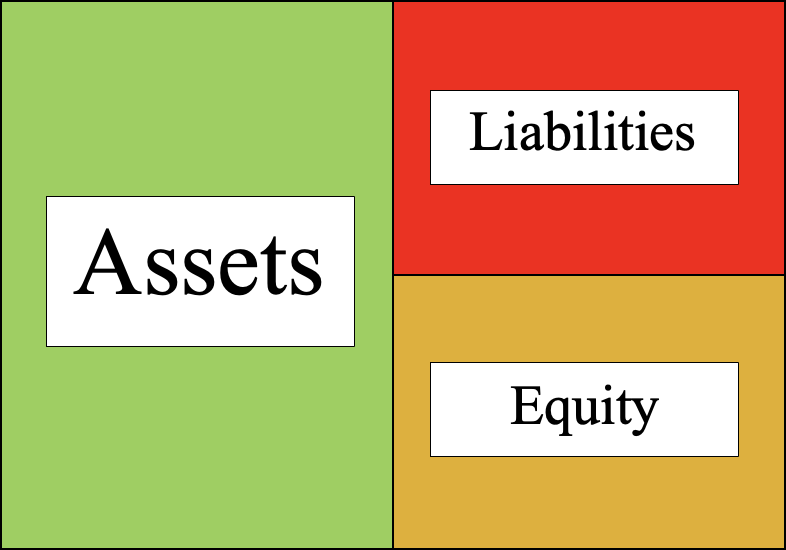

It’s like taking a snapshot of your stall’s finances. This snapshot includes what you own (your assets), what you owe (your liabilities), and what’s left over for you (your equity).

How to Create a Balance Sheet

Creating a balance sheet might sound tricky, but it’s not too hard once you break it down into three main parts: assets, liabilities, and equity.

- Assets: What You Own

–Current Assets: These are things you can easily turn into cash within a year. For our bakery stall, this could be cash in your till, ingredients for your baked goods, and the inventory of cakes and bread ready to sell.

– Non-Current Assets: These are things you keep for more than a year, like your oven, baking tools, and the stall itself if you own it. - Liabilities: What You Owe

– Current Liabilities: These are debts you need to pay within a year. For example, money you owe to suppliers for flour and sugar or a short-term loan you took to buy a new mixer.

– Non-Current Liabilities: These are debts you’ll pay off over a longer period, like a long-term loan for a major piece of equipment. - Equity: What’s Left for You

– This is essentially your stake in the business. It’s calculated by subtracting your liabilities from your assets. If you started your stall with some savings or reinvested profits, that’s part of your equity.

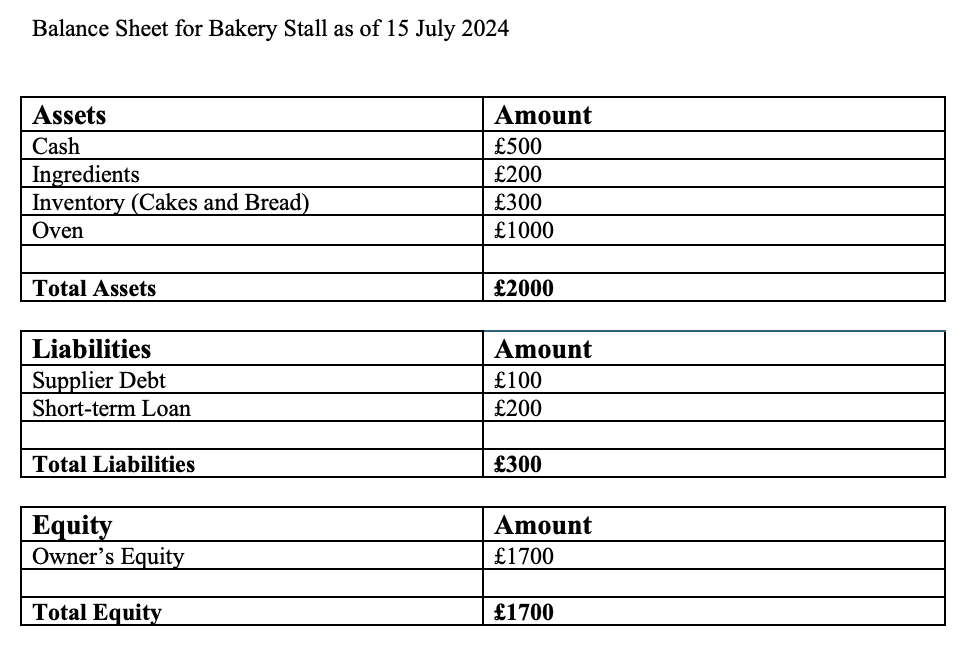

Here’s a simple example for a bakery stall:

Assets

- Cash: £500

- Ingredients: £200

- Inventory (cakes and bread): £300

- Oven: £1,000

Liabilities

- Supplier debt: £100

- Short-term loan: £200

Equity

- Owner’s equity: £1,700

To put it all together:

Here is where the magic happens.

The total assets must equal the total of liabilities and equity. This balance is why it’s called a balance sheet!

The Formula: Assets = Liabilities + Equity

Using the Balance Sheet

1. Tracking Financial Health

A balance sheet helps you see if your business is financially healthy. If your assets are much greater than your liabilities, you’re in good shape.

For instance, if you have lots of ingredients and cash on hand, it shows you’re ready for more business.

2. Making Informed Decisions

By looking at your balance sheet, you can make better decisions. If you see you have extra cash, you might decide to invest in a new oven or more inventory.

On the other hand, if your liabilities are high, you might focus on paying down debt first.

3. Getting Loans

If you ever need a loan to expand your stall, banks will want to see your balance sheet.

It shows them that you understand your finances and helps them decide if they should lend you money.

4. Monitoring Growth

By comparing balance sheets from different periods, you can track your growth over time.

Are your assets increasing? Is your equity growing? This helps you understand if your business strategies are working.

Let’s use the example of a Bakery Stall Expansion to explain this a little further:

The balance sheet shows a strong financial position with growing equity. You decide to use this information to get a loan for expanding your stall to include more items like cookies and muffins.

You present your balance sheet to the bank, showing them you have a solid business. The bank agrees to lend you the money because they see you manage your finances well.

With the loan, you buy new baking equipment and more ingredients, leading to increased sales and profits.

Using your Accounts

Throughout the financial accounting we have been talking about, you have started keeping an account of what you are spending, receiveing and what is left over after every transaction.

Your book holds all this information and should be easy now to draw on that information to show your balance sheet and give you an idea of where things are within your business.

Stay on top of this as a small business and it is quick to use. Leave it for a few weeks and you will have to go search through transactions to get your balances.

Little and often are wise words here so you don’t get accounting fatigue. (Alternatively use accounting software to do this for you or take on a book keeper and focus on what you know how to do best as a market stall holder)

Conclusion

The balance sheet is a powerful tool for any market stall holder. It helps you understand your business’s financial health, make informed decisions, secure loans, and monitor growth.

So, next time you’re tallying up your sales, take a moment to think about your assets, liabilities, and equity. You’ll be glad you did!

Quick Quiz

How can you use a balance sheet to make informed decisions about your business?

What are the key components of a balance sheet, and how do they reflect the financial health of the business?

Why is it important to understand the balance sheet before seeking external financing?